Ever been ready to buy something online and paused at the tiny box asking for your “CVV”? I remember staring at it the first time, wondering.

If it was a secret PIN or some hidden code. Spoiler: it’s simpler than it sounds — and much more important for your security than most people realize.

Quick Answer:

CVV means Card Verification Value. It’s a 3- or 4-digit security code printed on your debit or credit card that confirms you physically have the card during online or phone payments.

🧠 What Does CVV Mean in Text or Card Payment?

CVV stands for Card Verification Value. It’s a unique code used to authenticate online and card-not-present transactions.

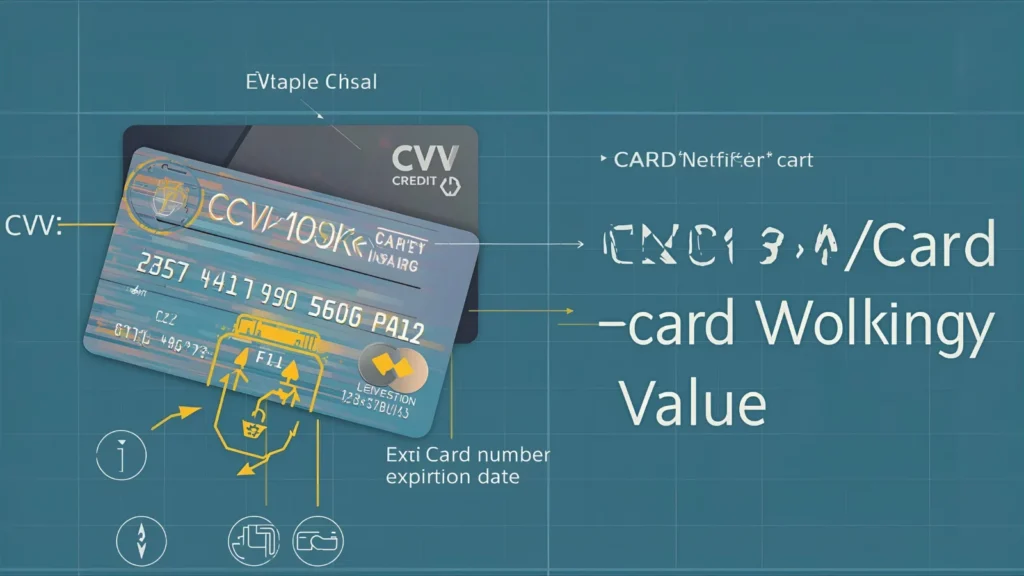

When you buy online, merchants usually ask for three things:

- Card number

- Expiration date

- CVV security code

This small number ensures you physically have the card, reducing fraud risk.

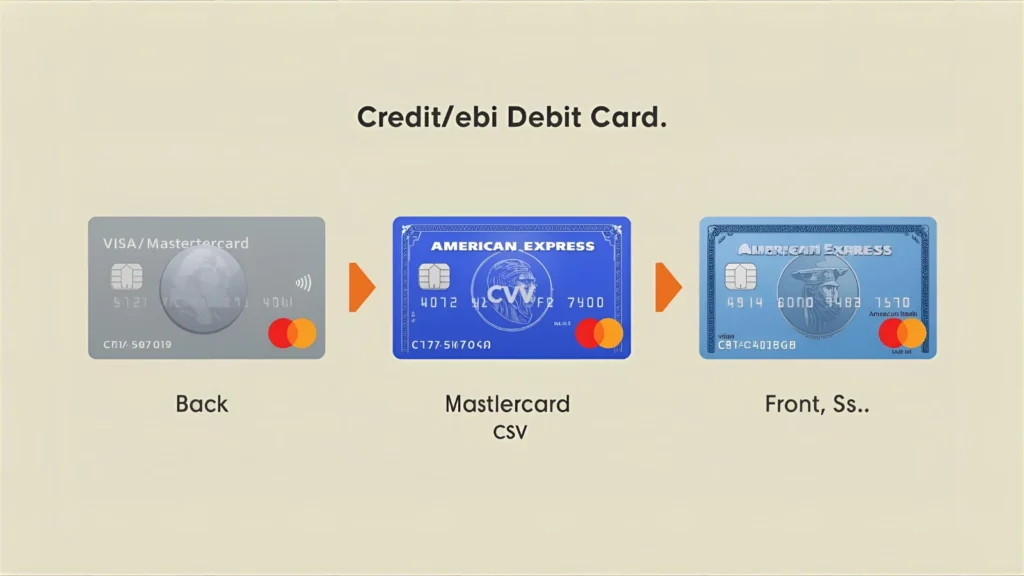

- Visa, MasterCard, Discover: 3-digit code on the back of the card

- American Express: 4-digit code on the front (called CID)

💡 Example sentence:

“Make sure you enter your CVV correctly — it’s the 3-digit code on the back of your debit card.”

In short:

CVV = Card Verification Value = Your card’s online security code.

📍 Where to Find Your CVV

Knowing exactly where your CVV is located is essential.

- Visa/MasterCard/Discover: 3-digit code on the back, usually near the signature strip

- American Express (AmEx): 4-digit code on the front, right above the card number (CID)

💡 Tip: Never share your CVV over text, email, or social media. Only enter it on secure, HTTPS-encrypted checkout pages.

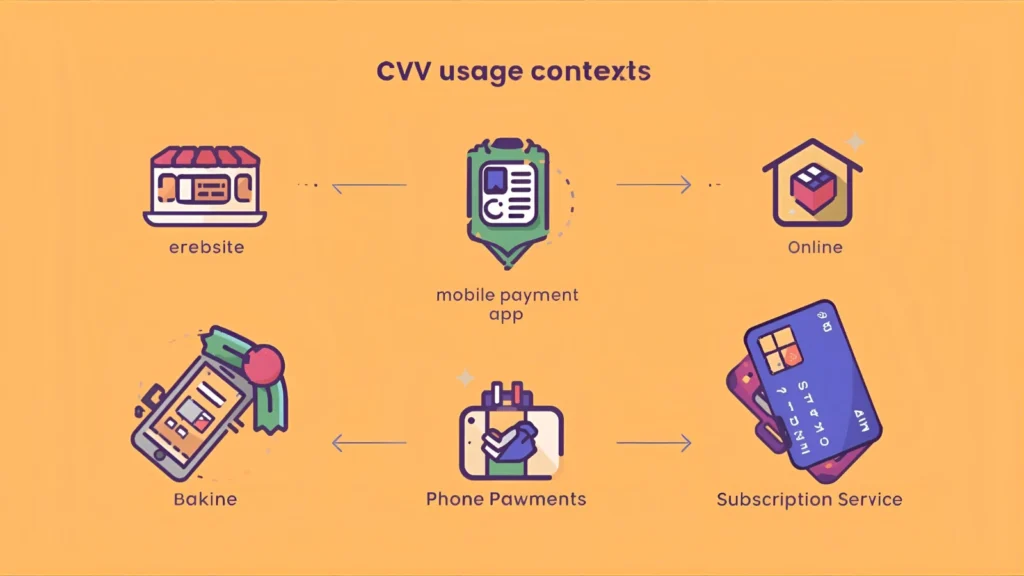

📱 Where Is CVV Commonly Used?

CVV isn’t slang — it’s formal and transactional. You’ll mostly encounter it when doing online transactions or digital banking.

Common places:

- 💻 E-commerce websites (Amazon, eBay, AliExpress)

- 📱 Mobile payment apps (Google Pay, Apple Pay, PayPal)

- 🏦 Online banking portals

- ☎️ Phone-based payments, when an agent asks for your card details

- 💳 Subscription platforms (Netflix, Spotify, etc.)

It’s part of the Card Not Present (CNP) system — ensuring the person making the payment actually holds the card.

💬 Examples of CVV in Conversation

Even though CVV isn’t casual slang, people reference it in online shopping or fraud-related conversations:

1.

A: can’t checkout 😩 it says invalid cvv

B: check the last 3 digits on the back of your card

2.

A: what’s cvv again?

B: the security code on your debit card 😂

3.

A: my mom tried to pay online without entering the cvv

B: lol that’s why it didn’t work 😅

4.

A: this site asked for my cvv in a dm 😳

B: scam alert 🚨 never share it!

5.

A: why does amex have 4 digits instead of 3?

B: that’s called a CID — same as a cvv for AmEx cards

🕓 When to Use and When Not to Use CVV

✅ When to Use:

- During online shopping or mobile app payments

- On official banking or payment sites (HTTPS only)

- For subscriptions or digital services

- When verifying card details in secure channels

❌ When Not to Use:

- Never share CVV via text, social media, or email

- Don’t enter it on untrusted or suspicious sites

- Avoid giving it over phone calls from unknown callers

| Context | Example Phrase | Why It Works |

|---|---|---|

| Online Shopping | “Enter your CVV to confirm payment.” | Secure verification |

| Bank Chat | “We’ll never ask for your CVV via SMS.” | Fraud protection |

| Group Chat | “Don’t share your CVV online!” | Friendly safety reminder |

🔄 Similar Slang Words or Alternatives

Here’s a quick glossary for related card verification terms:

| Term | Meaning / Full Form | When to Use |

|---|---|---|

| CVV | Card Verification Value | Debit/credit card security code |

| CVC | Card Verification Code | MasterCard variant of CVV |

| CID | Card Identification Number | AmEx 4-digit front code |

| CSC | Card Security Code | Generic term for CVV/CVC |

| OTP | One-Time Password | Temporary code for 2FA |

| PIN | Personal Identification Number | Used for ATMs & POS |

❓ FAQs About CVV

1. Where is the CVV on my card?

Visa, MasterCard, Discover: 3 digits on back. AmEx: 4 digits on front (CID).

2. What is CVV on a debit card?

Same as a credit card — security code for online or phone payments.

3. What does CVV stand for?

Card Verification Value.

4. Is CVV the same as PIN?

No. PIN = ATM or POS. CVV = online verification.

5. Is it safe to share CVV?

Only enter CVV on trusted HTTPS websites. Never share via text, email, or DM.

6. What to do if my CVV is compromised?

Call your bank, block your card, and monitor transactions immediately.

7. Why do websites ask for CVV?

CVV confirms cardholder has the physical card, reducing online fraud.

8. Can someone use my card with just the CVV?

Usually not — most transactions require card number + expiry + CVV.

9. What’s the difference between CVV and CVC?

Same purpose, different naming depending on card network.

10. What happens if CVV is wrong?

Payment will fail — verification stops fraudulent or incorrect transactions.

🧾 How CVV Works (Simple Explanation)

- Enter card number, expiry, and CVV on a checkout page.

- Payment gateway sends info to the card network.

- Bank verifies the CVV matches your card record.

- Transaction approved or declined — CVV ensures Card Not Present (CNP) security.

💡 Tip: Always check for HTTPS and padlock icons before entering CVV online.

🧾 Conclusion

Now you know exactly what CVV means, where to find it, and why it’s vital. That small 3- or 4-digit code is your card’s digital bodyguard.

Whether entering it on Amazon, Netflix, or a bank portal:

- Never share CVV with anyone

- Always use trusted websites

- Contact your bank immediately if you suspect compromise

CVV = Card Verification Value — your personal key to safer online payments. 💳

Naz Fatima is an author at Saypadia who specializes in writing clear, relatable, and reader-friendly content about language, expressions, and modern terminology. She enjoys breaking down meanings with real-life context so readers can quickly understand and apply them. Naz’s work reflects a strong commitment to clarity, accuracy, and helping users find quick answers without confusion.